Public Urge Crackdown on Company Secrecy Offered by UK and Its Tax Havens

The majority of Britons (57 per cent) believe that company owners should not be allowed to keep their identities secret with most (57 per cent) saying they are suspicious of the owners’ motives where that is the case

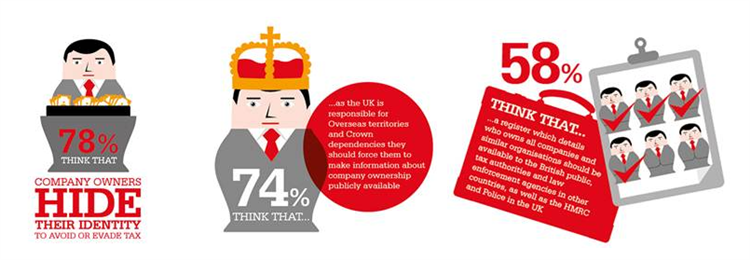

Key reasons cited by the public as to why a company owner would remain anonymous were tax avoidance and evasion (78 per cent), to hide their true wealth (70 per cent) and the hiding of criminal behaviour (59 per cent).

The findings, in a new ComRes poll commissioned by Christian Aid, show feelings continue to run high about tax dodging just months after a G8 summit chaired by the UK Government promised measures to curb abuse.

The poll showed that overall, public opinion continues to harden against the tax strategies of multinationals. Some 84 per cent of those polled expressed anger at multinationals avoiding tax, up from 80 per cent in an earlier ComRes poll for Christian Aid in February this year.

Just over a third, 34 per cent, of people are still boycotting the products or services of a company because they do not pay their fair share of tax in the UK, the same percentage as in February, but many more people are considering such a boycott, 51 per cent, up from 45 per cent earlier this year.

The G8 summit made some inroads, endorsing the principles of automatic exchange of information between tax authorities and limited country-by-country reporting by multinationals, as well as the setting up of registries of company owners.

In addition, a number of tax havens, including the UK Crown Dependencies of Jersey, Guernsey and the Isle of Man, and British Overseas Territories such as Bermuda and the Cayman Islands, agreed to sign up to a key convention that would help identify instances of tax dodging.

But with little evidence of progress since the G8, however, and concern that Prime Minister David Cameron is rethinking his own pledge to set up a public registry of ownership, public anger remains unabated.

More than half of those polled, some 58 per cent, agreed that a registry of ownership should be open to the public, as well as to tax and law enforcement authorities, including the police, both in the UK and abroad.

Christian Aid senior economic justice adviser Joseph Stead called on the UK Government to lead the way. ‘At the G8 the UK Government endorsed the principle of a register of individuals who control UK companies, for use by police and tax authorities,’ he said.

‘The Prime Minister wanted to go further and make it public. If he changes his mind now, he will undermine his own commitment to transparency,’ he said.

‘Our poll shows there is clear public demand for a register that is open to all. Business Secretary Vince Cable must resist the inevitable pressure from some businesses and tax lawyers against such a registry, and deal a fatal blow to corporate secrecy.’

On the question of secrecy of ownership, only 23 per cent of respondents were aware that a UK company can be legally set up with anonymous owners, and only nine per cent said company owners had a right to such privacy.

Some 74 per cent of those polled say the UK government should now ‘force’ the Crown Dependencies and British Overseas Territories to make information about company ownership publicly available.

Christian Aid is calling on the public to email business secretary Vince Cable to ensure public registers are created which reveal who owns what, where, and for whose benefit.

Related: Christian Aid's Al Roxburgh, a member of Trafalgar Road Baptist Church, blogs on why it's time to end the phantom firms